New Humans of the Economic World

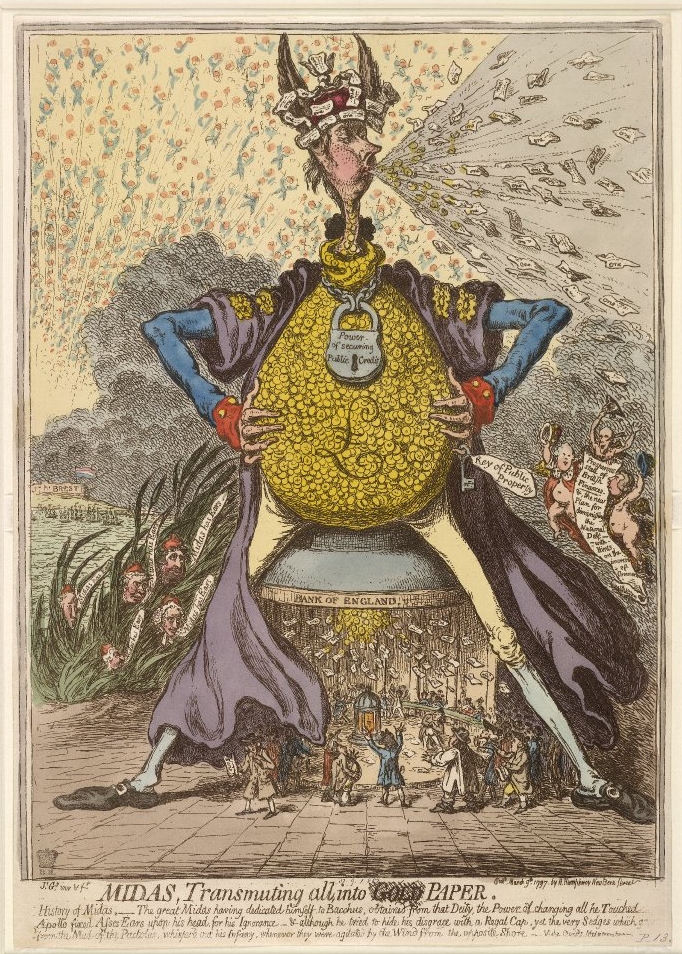

The aversion to financial excess and the paper promises of global finance is palpable in modern culture. Decadent stockbrokers and criminal CEOs populate many recent blockbuster films, and the figure of digitized money with no real relation to a stable form of value is strewn across media and popular culture. Perhaps this is because money is also a mediator of the borders of the human, and especially because economic man is not ‘really a human’.

In any case, the tension between money and man has a rich history in literature. In Anthony Trollope’s 1875 serial novel, The Way We Live Now, a society regulated entirely by money and monetary concerns is vividly painted as a threshold to a new – and grim – world order. Inheritance and “the winning of heiresses” is the supreme goal for most of the characters, as is the case in many Victorian novels, and the hunt for landed capital is ironically undermined by counterfeit banknotes, false signatures, inflated credit and other paper forgeries. Trollope’s novel excels in entangling moral and economic conservatism in the new forms of social and public existence rendered upon society by the accelerating momentum of industrial capitalism. Most characters embody this dissonance and struggle – mostly in vain – to balance survival with integrity. There are a few characters, however, who have transcended the realm of social morality entirely to become enmeshed in pure economic acceleration. One is Augustus Melmotte, “the Satan of speculation” who rides a magnificent wave of feverish stock ventures straight into the corridors of power to become “the impregnable tower of commerce”; a leaning tower, ironically, which falls victim to the whims of public credit and the capitalist cycle of successes and ruins. The most interesting character, however, is the American capitalist, Hamilton Fisker, who is not troubled by the weight of moral fiber that eventually becomes the motivation for Melmotte’s suicide. Fisker is described negatively in a distinctly English voicing of the capitalist’s lack of traditional values:

“He had never read a book. He had never written a line worth reading. He had never said a prayer. He cared nothing for humanity. He had sprung out of some Californian gully, was perhaps ignorant of his own father and mother, and had tumbled up in the world on the strength of his own audacity.”

This opacity of history and character is invested in a conservative nationalistic aversion to the untraceable, the invisible and the ‘uninherited’, an aversion mirrored by a palpable hesitance toward paper money in many economic theories of the period. Fisker is, tellingly, one of the few characters in the novel that is never at some point bankrupt; economically because he traverses the ‘financialized’ reality with complete and manipulative determination, morally, because he is an ethical vacuum and thus impervious to matters of ‘personal’ ruin. The narrator interestingly sums up his character in Napoleonic terms towards the end of the novel:

“According to his theory of life, nine hundred and ninety-nine men were obscure because of their scruples, whilst the thousandth man predominated and cropped up into the splendour of commercial wealth because he was free from such bondage. […] But the work of robbing mankind in gross by magnificently false representations, was not only the duty, but also the delight and the ambition of his life.”

Fisker is thus a paradoxical figure. As a stereotypically American capitalist, he is the odd-man-out in the London of the novel, but at the same perfectly assimilated in its accelerating progress toward “the age of money”. In this way, Trollope casts the embodiment of capitalist acceleration as a radically new type of man, the one-in-a-thousandth, the economic Napoleon that, in an almost Nietzschean vein, transcends the boundaries of traditionally anchored humanity and becomes Homo Economicus, the abstracted entity of self-interest that still informs economic theory today. As an embodied economic abstraction, Fisker is an example of a recurring character in realist fiction of the nineteenth century, as seen in the foreign and semi-criminal capitalists ranging from Balzac’s Vautrin via Dickens’ Mr. Merdle to Zola’s Saccard – even Fitzgerald’s Gatsby, all of which interestingly anticipates the immoral and corrupted characters we see in modern blockbuster films about the shadows of capitalism. A good example of this is Scorsese’s 2013 film The Wolf of Wall Street, where financial crime and forgery (and financial success) is framed as a sort of physical, ‘medicinal’ and sexual decadence.

All of these ‘new humans of the economic world’ are not radicalized consumers or ‘examples to be avoided’. Instead, they give form to the contradiction that the global economy, on which we all depend, functions on a set of equations and abstractions that are distinctly not human. At the same time, they have one distinguishing feature in common, one that is a historically constant trope that surfaces in times of financial instability: They have realized that money, credit and capital are, simply, fictions; fictions that can be manipulated and counterfeited, fictions that are, as a fellow stockbroker tells the protagonist in Scorsese’s film, “Not fucking real!”